Workers’ Comp Update

Master Workers’ Comp Policies for PEOs and Staffing Companies

Workers’ Compensation coverage continues to be a big problem for startup PEOs and staffing companies. In certain states (California, for example), it is nearly impossible to find a carrier willing to take a chance on a startup operation.

Workers’ Compensation coverage continues to be a big problem for startup PEOs and staffing companies. In certain states (California, for example), it is nearly impossible to find a carrier willing to take a chance on a startup operation.

“The staffing industry is particularly tough.” agent Will Tenney tells us. “Carriers that would have a look before have closed their eyes. The rising cost of claims is causing insurers to exercise extreme caution with untested staffing and PEO companies.”

The business has always been cyclic in nature, and it appears that a downturn is due.

What Changed?

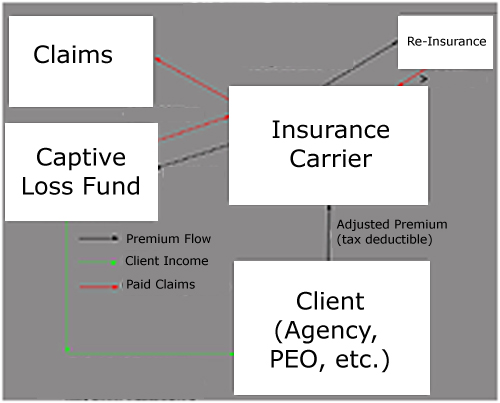

The comp industry is best described as “long tailed.” Incidents and occurrences that happened 6 to 8 years ago are still showing a large effect. In states like California and New York, the policies of “employee first” are starting to show costs. The practice of “pay first, investigate later” is taking it’s toll on carrier surplus, and claims reserves are rising throughout the industry.

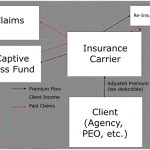

A spokesperson from a national carrier with a large PEO/staffing presence told us, “It’s not that PEOs and Staffing companies have a higher incidence of claims. That seems to be a level playing field. However, the process of resolving them can take longer when dealing with high deductible policies. Hence, the reserves build up and are held for a longer period of time. This makes taking on a startup PEO or staffing company a much riskier proposition to the actuaries.”

Is There an Upswing Coming?

The answer most given is “too soon to tell.” The wave of optimism sweeping the industry with a conservative administration is there, but many are waiting for that “long tail” to pull through.

What Can a Startup Do?

PEO Pros has been challenged by this dilemma. Clients have been advised to seek out a state fund / assigned risk situation to develop some history (at least three years.) This makes them much more attractive to a carrier.

Why Does Three Years History Help?

When a carrier takes the risk of underwriting a PEO or staffing firm, the potential downside can be very large. Consider a standard $250K high deductible policy. Should the PEO or staffing firm go under the carrier is then responsible for all the claims and associated expenses. Collateral helps, but doesn’t cover it all except in rare cases. The legal costs alone usually eat through collateral in a rapid fashion.

The actuaries prefer to have an established “book of business” to study, to predict performance by studying trends, and the three year (minimum) history.

Why Can’t We Grow Organically?

PEO Pros tells us: “We get asked this all the time. The startup wants to know what they can write and they will go find it. It sounds like a perfectly good business plan until you see the actuary’s side of it. They have no history, no performance metrics or industry trends to study. It is difficult to make a decision in a vacuum.”

Certainly, an established firm can continue to grow organically, but the initial approval is going to require a measurable book of business.

This is frustrating to startups. PEO Pros relates to us: “We often hear the complaints from the startup firms with words to the effect of ‘How are we supposed to start a business?’. It is frustrating to us as well, as we want to help. It is not a pleasant feeling, advising someone to go to a state fund to get three years experience first.”

What Can a Startup Do to Enhance Our Prospects?

There are a few things you can do to make your submission more attractive:

- Assemble a spreadsheet of proposed clients that have at least three years loss history

- Have company and personal financial statements ready, current and in good shape

- Senior board and staff resumes should reflect many years experience in the industry

- Avoid the tough states for now. Set up a corporation in an easier state and start there, before expanding in to California, New York, etc.

- Consult with PEO Pros about putting together a professional submission letter

If you would like to hear more about a master workers’ comp policy for your PEO or staffing firm, please call us at 407-490-2468 or use the contact form below.

Are you an employer who would like to have one point of contact to deal with all of your insurance problems? Are you tired of having to “look up” which agent handles that particular issue?

Are you an employer who would like to have one point of contact to deal with all of your insurance problems? Are you tired of having to “look up” which agent handles that particular issue?

This article is an outline of a talk that our CEO gives to various groups. Please contact us if you are interested in such a talk

This article is an outline of a talk that our CEO gives to various groups. Please contact us if you are interested in such a talk