Many times a day, we are asked if there is a way to get a discount on workers’ comp premium. In Orlando, other parts of Florida, and indeed nationwide, this is a daily part of our workers’ comp quotes process. There are both short and long answers to this.

Many times a day, we are asked if there is a way to get a discount on workers’ comp premium. In Orlando, other parts of Florida, and indeed nationwide, this is a daily part of our workers’ comp quotes process. There are both short and long answers to this.

Short Answer: “Yes, sort of …”

Long Answer

Every state in the country handles workers’ comp their own way, and not surprisingly, no two states are alike. however, at the risk of generalization, we will put states in two categories: Administrative States and Loss-Cost States. Each is discussed below.

Administrative Rates

Many states set the rates for workers’ comp, or at least the “base rate”. Florida, for example, defines the manual rate for each workers’ comp classification code, with help from the National Council for Compensation Insurance (NCCI). These rates can be modified by various factors, including credits for a drug free workplace, a written safety program, a very complicated and confusing program for construction credits, and for all companies the actual claims experience can be taken in to effect.

Loss Cost Factors (LCF) or Loss Cost Modifier (LCM)

Other states may have a base rate table which is multiplied by the insurance carriers LCM, as determined by historical claims data. In addition, some states let the carriers set their own rates for each class code, which is then put through an extensive approval process.

Stay with us, we told you this is the Long Answer …

So how does this help a business owner get discount rates? There are two options we will discuss today, traditional policies and co-employment solutions using a PEO.

In a state like Florida, the traditional policy rates can only be affected by credits and experience modifiers. Credits are offered for a verified, written safety program (2% discount) and a certified Drug Free Workplace program (5% discount). There are also some very confusing credits for new construction, which have not been a major factor in the last few years, sadly. A company that has been paying comp premium for more than 2 years may also be eligible for an Experience Modifier Adjustment. Every new company starts with a multiplier of 1.0, that is, no modification at all. Have a couple of good years with no claims, that multiplier can be less than 1.0, say .92 or .83 for example. Have a couple of bad years with a lot of claims and that multiplier can go up. There are also programs which can refund premium or pay dividends to policy holders, but these are usually restricted to annual premiums of $50,000 or more.

In a state like Florida, the traditional policy rates can only be affected by credits and experience modifiers. Credits are offered for a verified, written safety program (2% discount) and a certified Drug Free Workplace program (5% discount). There are also some very confusing credits for new construction, which have not been a major factor in the last few years, sadly. A company that has been paying comp premium for more than 2 years may also be eligible for an Experience Modifier Adjustment. Every new company starts with a multiplier of 1.0, that is, no modification at all. Have a couple of good years with no claims, that multiplier can be less than 1.0, say .92 or .83 for example. Have a couple of bad years with a lot of claims and that multiplier can go up. There are also programs which can refund premium or pay dividends to policy holders, but these are usually restricted to annual premiums of $50,000 or more.

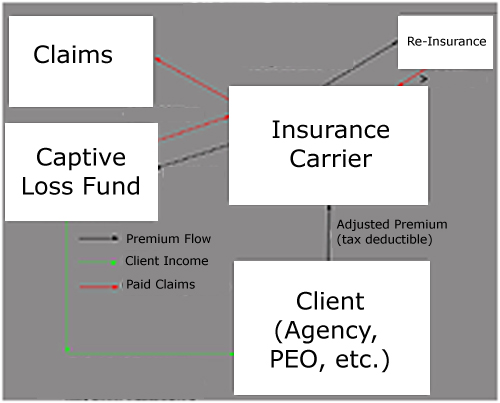

Using a PEO in a Co-Employment Situation is a completely different scenario. In this case, the PEO becomes the employer of record (for comp purposes among others) and pays whatever rate they pay for their employees. Since the client’s employees are now the PEO’s employees, the client no longer pays comp premium, but instead pays a service charge to the PEO. This number is unregulated and negotiable. It is possible for a safe client to negotiate a much lower rate on workers’ comp. Conversely, a client who can’t get coverage from a traditional carrier (because their risk is actually much higher than the state set rate would bear), can get coverage from a PEO by negotiating an equitable service charge.

So while paying a PEO is technically not paying for workers’ comp insurance (it’s their insurance, not yours), you can get your employees covered at a discount rate.

If you have more questions on this topic please use the contact form below:

It seems that payroll companies are on the rise, and more and more they are looking for workers’ comp coverage for their clients.

It seems that payroll companies are on the rise, and more and more they are looking for workers’ comp coverage for their clients.