More Complexity – in Unemployment Taxes

As if Obamacare isn’t bad enough, now small employers have to worry about the complex issue of rising unemployment insurance and tax rates. Formerly a rather simple calculation, things have happened in several states that make things complicated.

As if Obamacare isn’t bad enough, now small employers have to worry about the complex issue of rising unemployment insurance and tax rates. Formerly a rather simple calculation, things have happened in several states that make things complicated.

Just what an employer needs, another thing to worry about.

It is a justified headache to worry about, too. Failure to properly pay unemployment taxes in a timely and correct fashion can result in penalties, interest and fines that far exceed the original amount owed.

So why the confusion?

Many states are not paying back loans they have drawn from the federal unemployment fund per the original Federal Unemployment Account act. In fact 19 states and the US Virgin Islands currently have loan balances (see the chart below)

The Federal Unemployment Account (FUA) provides for a loan fund for state unemployment programs to ensure a continued flow of benefits during times of economic downturn. According to the U.S. Department of Labor, Employment and Training Administration, 19 states and the U.S. Virgin Islands currently have loan balances in their Trust Fund accounts.

As of January 3, 2013, the most recent balances of outstanding state loans from the FUA are:

| State | Loan Balance | Began Borrowing |

| Arizona | $313,792,552.96 | March 2010 |

| Arkansas | $234,438,497.54 | March 2009 |

| California | $10,303,642,800.21 | January 2009 |

| Connecticut | $631,483,916.97 | October 2009 |

| Delaware | $76,412,258.04 | March 2010 |

| Florida | $630,816,097.02 | August 2009 |

| Georgia | $540,451,764.60 | December 2009 |

| Indiana | $1,767,543,083.93 | December 2008 |

| Kentucky | $837,664,856.16 | January 2009 |

| Missouri | $569,174,955.03 | February 2009 |

| Nevada | $685,308,839.53 | October 2009 |

| New Jersey | $957,235,892.50 | March 2009 |

| New York | $3,487,357,392.47 | January 2009 |

| North Carolina | $2,555,704,831.88 | February 2009 |

| Ohio | $1,739,094,085.65 | January 2009 |

| Rhode Island | $199,470,182.74 | March 2009 |

| South Carolina | $675,597,745.87 | December 2008 |

| Vermont | $57,731,860.63 | March 2010 |

| Virgin Islands | $54,743,040.87 | August 2009 |

| Wisconsin | $859,864,002.08 | February 2009 |

| Total | $27,177,528,656.68 |

Source: National Conference of State Legislatures

Why is This Raising our Rates?

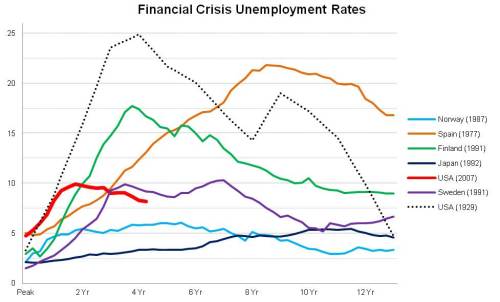

Previously, the FUTA, or Federal Unemployment Tax Act, was assessed on the first $7,000 of each employees wages. That number may be raised to $8,00 or $8,500, (depending on who you talk to) largely because the states have not paid back their loans. There is also another negative effect from this. The Standard Federal Tax Rate is set at 6.0% (formerly 6.2% but the extra .2% was repealed in 2010). This is high, and would be an excessive burden on employers. To counter this, the federal government has been extending a discount of 5.4% to all those states that are not in arrears. That makes the national rate 0.6%. However, since states are now “raiding” the unemployment funds for various expenses, including but not limited to unemployment benefits, they find themselves unable to pay back the loans. The discount is being reduced by a rate of 0.3% per year to all those states in arrears.

In Florida for example, 2012 marked the second year in arrears, so the FUTA rate in Florida for 2012 is set to 1.2%. Since it does not appear likely that Florida will pay back the loans this year (or any year for that matter) we can expect the FUTA rate to keep increasing until it reaches the maximum of 6.0%.

Is it a tax or insurance?

Good question. Since it is required by ALL employers, does it make a difference? Employers mustpay it: to the state quarterly (usually) and to the Federal fund annually (form 940). The checks are written to the IRS or the state equivalent so for working purposes, call it a tax.

What can an employer do about it?

The most important thing to do about it is to stay on top of it, and make sure that there are enough funds to pay the correct amount of unemployment taxes at the end of the fiscal year, when filing the 940. This is best served by consulting with an expert in the field, or making it someone else’s problem.

Who are the experts?

CPAs are trained in tax laws. Most of them do an excellent job of making sure an employer is in compliance.

Wait, How Can an Employer Make it Someone Else’s Problem?

More and more employers are placing their employees in a co-employment situation with a PEO or Employee Leasing company that shares a large part of the responsibility of tax compliance. In this way they know they have an expert as a partner.

For more information on this subject please use the contact form below:

This article is an outline of a talk that our CEO gives to various groups. Please contact us if you are interested in such a talk

This article is an outline of a talk that our CEO gives to various groups. Please contact us if you are interested in such a talk