Has your workers’ comp coverage been denied or canceled? Not yet? Maybe it isn’t your turn just yet? If renewal time is coming up and you are worried, there are some steps you can take to make it easier.

Has your workers’ comp coverage been denied or canceled? Not yet? Maybe it isn’t your turn just yet? If renewal time is coming up and you are worried, there are some steps you can take to make it easier.

What is involved in getting workers’ comp coverage? Understand that the insurance company is in the business of managing risks and they are taking a risk every time they add or renew a client. Your goal as a business owner then, along with your agent, is to convince the insurance company, or more specifically the underwriter, that you are a risk worth taking.

Here are the top 10 reasons why company owners either can’t get workers’ comp coverage or have it canceled or denied.

#10: Failure to be specific about what you do.

The ACORD form isn’t always enough. A detailed description of operations goes a long way in to convincing an underwriter that you are worth underwriting. It’s important to use percentages as well. For example, a lawn service company may want to say “80% residential and 20% commercial.” Make sure to list known excessive risk exposures too, such as how often you trim trees, or clean out gutters (involves getting on a roof.) Underwriters do not like surprises!

#9: Failure to maintain a safety program.

This is going to show up in your claims report sooner or later. A safety program not only has to be written, but enforced. Some roofers were seen working on a county school roof recently. They all had harnesses on but they were hooked to nothing. Doesn’t help much. Make sure your employees know the safety program and follow the rules.

#8: Spreading your company too thin.

So many companies try to do more than one thing. A famous person once said “If you try to be everything to everyone, you are going to end up being nothing to nobody.” Find your niche, stick to it, and don’t branch out in to other, riskier areas.

#7: “Shopping” your insurance around on a regular basis.

Sounds like a good business move doesn’t it? It’s not. Underwriters do not want to see your application year after year. Your company will get a reputation as a “policy jumper” and it will become more and more difficult to get a single company to take a chance on you.

#6: Underestimating your payroll to reduce premium.

Admittedly, a lot of times this is the fault of the agent. He or she underestimates your payroll to get you a lower quote. It has a downside, in that it makes you that much less attractive to the carrier. Report your payroll figures as accurately as possible. You plan on growing your company don’t you? It is OK to put that growth in your estimated payroll.

#5: Using too many subcontractors.

Lawyers have learned to “pierce the veil” and “climb the ladder” in subcontractor claims. If more than 20% of your business is handled by subs you are going to have a difficult time getting a traditional workers’ comp policy. Some companies have gone to strategic partner – referral arrangements, rather than subcontracting, because it separates the liability. Granted, you lose control of the cash flow but it is a lot easier to insure.

#4: Using “1099 employees”.

Let’s be clear, there is no such thing as a “1099 employee”. 1099s are reserved for independent contractors. Employees get W-2s. There is no middle ground. If you are paying employees as contractors, and therefore avoiding taxes and premium, sooner or later it will be revealed. The longer it takes to get caught, the more expensive it will be. Be very careful with this. Many states (and the IRS) are cracking down on this.

#3: Owning too many corporations or LLCs.

Workers’ compensation rules are different in different states, but all of them realize the potential cross-company liability of shared ownership companies. So much in fact, that there is a special form (ERM-14) that has a section dedicated to insuring companies with common ownership. While it may seem like a good idea to have multiple companies, most CPAs will tell you that the advantage is minimal compared with the extra paperwork and insurance difficulties. Check with your CPA of course, but it may be to your advantage to have different divisions within one company as opposed to having separate entities.

#2: Putting too much on your website.

Underwriters have the internet on their computers. They know how to use Google. Be assured they will comb every inch of your website to make sure you aren’t doing some high risk activity that you aren’t reporting. This has been the killing blow for several companies trying to get comp coverage. Which leads to the last, and most grievous error companies can commit:

#1: Lying to the insurance company (or agent).

Once you are caught lying on a form, or in an underwriting survey you are pretty much done for. We don’t know exactly how but we know that underwriters communicate with each other. We suspect they have a private Facebook group they tell stories in, and have good laughs about their latest “applicant.”

Never, ever, ever put false information on an insurance form. It’s in writing then and goes on your record. Don’t do it.

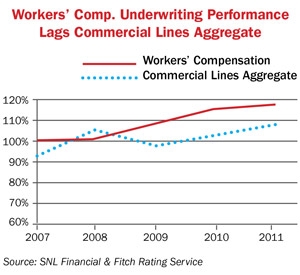

One of the unforeseen negatives of the Affordable Care Act was increased costs for workers’ compensation insurance, coming both from higher taxes assessed to insurance companies and higher costs of claims. The claims costs are on the rise due to more dependance on workers’ comp vs. traditional health insurance, increased medical costs and the big one, increased legal fees.

One of the unforeseen negatives of the Affordable Care Act was increased costs for workers’ compensation insurance, coming both from higher taxes assessed to insurance companies and higher costs of claims. The claims costs are on the rise due to more dependance on workers’ comp vs. traditional health insurance, increased medical costs and the big one, increased legal fees.